-

Is a diamond a good investment?

-

Investment Diamond Guide

-

Channels for investment

Diamond tends to hold its value

The world‘s oldest known diamonds have been found were formed 4.25 billion years ago, and the youngest diamonds have been found are 900 million years old. Diamond is in fact the hardest substance known to man. Most natural diamonds are formed at depths of 140 to 190 kilometers in the Earth’s mantle.

Natural fancy diamonds are extremely rare and the more intense the color, the rarer and more expensive the fancy colored diamond will be. Research indicated that only one in every few thousands of diamonds obtains enough natural color to be classified as a fancy color diamond. Since early 80th until now, the price of fancy colored diamond increased by 300% to 400%.

If dividing the gold holding on Earth to everyone, everyone can get 21 gram. With platinum, everyone can get 2 gram, but with fancy colored diamond, everyone can only get 0.036 gram.

Permanent Beauty and luxury

After days and ages, the beauty of diamonds will still last. At present, diamond is no longer with strange and unreachable image, but getting more and more involved in our life.

Portable and safe inherit

Diamond has some unique natures, which enable it to be easily transferred, and there is no regulation for registration. Diamond’s secret trading way and easy for safe deposit fetched out its character.

According to the recently issued regulation in China regarding the Government imposes on inheritance tax, diamond, and article for amusement and painting are not listed as items for tax payment. This regulation added more value on diamond collection and inheritance.

Price transparency and stable increasing rate

The diamond industry addresses the transparency of pricing on the global marketplace and establishes complete price reporting system. The establishment of Rapaport Group provides the opportunity for people to view and refer real time price for diamonds based on size, color and clarity.

Due to the fact that diamond has relatively high carrying value, diamond investments are specialists in high yield return and low risk. In recent year, all diamonds have historically increased in price at an average of 25% per annum comparing to other metal. Diamonds are not like other metals; the financial market has relatively small impact on its price increasing.

Investing in Naturally Fancy Colored Diamonds

Natural fancy colored diamonds are exceptionally rare, which contributes its steady growth in demand and increased prices. Fancy intense yellow diamonds have seen a 170% price appreciate on the market, which indicates a new round of trends in investing fancy colored diamonds. The coming years are predicted to show a new trend in fancy blue diamond investment

Cash in your diamond globally

In European countries and America, it is a very popular way to invest in diamonds. Investors are able to cash in their diamonds through several ways, such as mortgage, financing, auction and trade-in. These channels enable investors to cash in their diamonds globally.

Before actually making the decision to purchase a diamond, consumer always has some concerns:

It is hard for consumer to calculate the real price for a diamond. Even people within the diamond industry, diamond pricing is sometimes a troubled issue. Fortunately, the internet has changed this situation for normal consumers.

How to choose a diamond to invest?

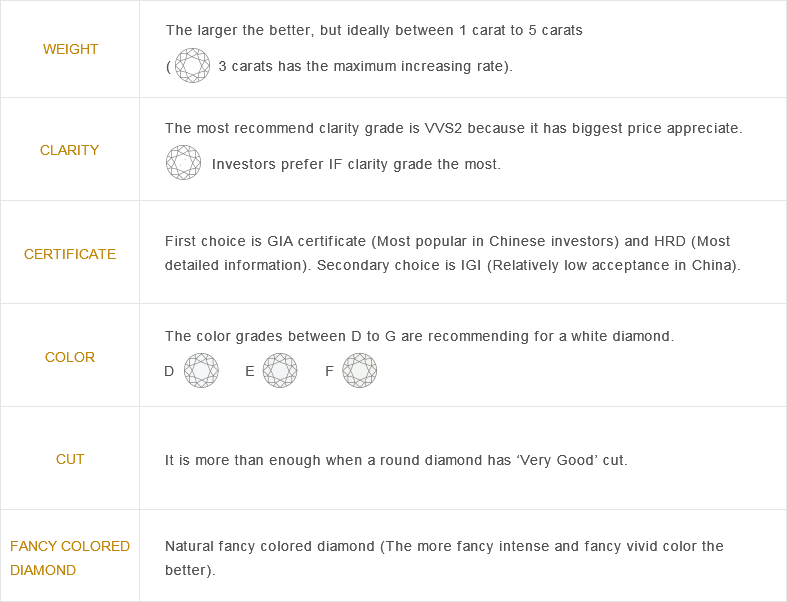

Professional advice:we suggest you to invest a diamond with following features:

Channels for investment:

Ever since 1934, diamonds value has largely appreciated exceed inflation rate. Therefore, it is a wise decision for investors to invest in diamonds in order to prevent asset loss. In recent year, value of diamonds does appreciate in an optimal inflation. Diamond is not only a concentrated form of investment, but also ensures the privacy of personal investment since diamond sale is not subject to any reporting requirement. During the investment, there is also no withholding, insurance or property tax required for diamond investment. Unless other investment items with dramatic fluctuations in prices, diamond hold their value over time. There is not any country or government has diamond holding, diamond free trade market is not controlled or influenced by any country in the world. Diamond are always in demand globally, which make it has potential for currency gains and been easily traded in US$.

Diamond price is always increasing stably and has remarkable return on investment (ROI) which is around 3%-5%. Diamonds with different quality have different appreciate; high-quality diamonds normally have higher appreciate. Research indicates that since 1948, diamonds with color grade above G and VVS clarity, their price increase annually over 10%. Diamonds with 3xEx ‘Antwerp-cut’ the price increases annually by 20%. Until 2023, it is estimated the demand of diamonds globally will increase 5.1% yearly. Diamond mines are nearly deleted, and amount of diamond mining suffers a continuously decreasing, it is possible that every single step within the diamond industrial chain will increase their price. In diamond market, only diamonds are 1 carat or above can appreciate and hold value in times of inflation.

Van Anvers is based in the diamond club of Antwerp, where the largest place for diamond package deal, inlay machining, professional identification and direct sales. Van Anvers is focus on dedication to customer service and extensive selection of high-quality loose diamond. Van Anvers also provides diamond trade-in service for customers. Van Anvers is your first choice of investment and collection for high-end buyers in this fast-changing financial market.